China Surpasses US As The World’s Richest; Experts Ask For How Long?

Riding on global wealth bloom attributed to the higher asset prices, China has surpassed the U.S. as the richest nation in the world. However, there is a debate whether China can occupy the top slot for a longer period.

Global wealth has tripled in the last few decades. From $156 trillion in 2000, world's net worth rose to an unprecedented $514 trillion in 2020, and China took the largest single share of one-third of it, McKinsey & Company, that examines balance sheets of ten nations representing more than 60 percent of global income, said.

The U.S., held back by the muted increases in property rates, saw its net worth more than double during the period to $90 trillion.

China's wealth rose astronomically to $120 trillion from a mere $7.0 trillion in 2000, the year Beijing joined the World Trade Organization, the management consulting company said in a study.

"We are now wealthier than we have ever been," Jan Mischke, a partner at the McKinsey Global Institute, said in an interview in Zurich.

Showing an upward trend, more than two-thirds of the wealth in both countries is held by the richest 10 percent of households, McKinsey said.

In its study, McKinsey found that 68 percent of global wealth is stored in the real estate sector, followed by infrastructure, machinery and equipment. Financial assets that are effectively offset by liabilities are not counted in the global wealth calculations.

The study found that the intangibles like intellectual property and patents form a much lesser extent of global wealth.

The ballooning property prices coupled with declining interest rates, according to McKinsey, resulted in the steep rise in net worth in the last 20 years. Thus, there is a debate whether China occupying the top slot for a longer period.

Casting doubts on the sustainability of the current wealth boom, the study stated that asset prices are almost 50 percent more than their long-run average relative to income.

"Net worth via price increases above and beyond inflation is questionable in so many ways," Mischke said in the interview. "It comes with all kinds of side effects."

The study predicted the nightmare scenario in the aftermath of a collapse in asset prices. The meltdown will erase as much as one-third of global wealth (33 percent), it predicted.

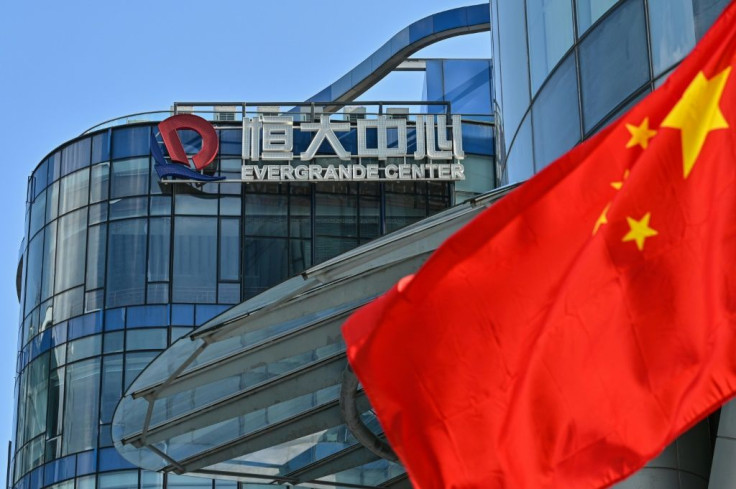

The real estate sector in China is hit by lower sales and many developers are defaulting of late. China's Evergrande Group, touted as the poster boy of the Chinese real estate boom, collapsed Sept 20 after the property developer failed to make payments on some of its debt. On Sept. 23, the private-sector home builder missed to pay an $83.5 million interest payment due on its dollar-denominated bonds.

The asset price boom led to the 2008 global financial crisis with the housing bubble burst in the U.S. and the collapse of Lehman Brothers, the fourth largest bank in the U.S. then.

To stave off a similar crisis, the study suggested distribution of world's wealth into more productive investments that can expand global GDP in a more fruitful manner.